Macro Insights 宏观分析

Deep analysis of macroeconomic trends and market dynamics 宏观经济趋势和市场动态的深度分析

Historical Echo: When the Fed Compromises with Politics, Triggering a Decade of Stagflation 历史的回声:当美联储妥协于政治,引爆十年滞涨

August 28, 2025 - Federal Reserve Chairman Powell's Jackson Hole speech analysis 2025年8月28日 - 美联储主席鲍威尔杰克逊霍尔讲话分析

Click to expand analysis 点击展开分析

On August 22, Federal Reserve Chairman Powell delivered a significant speech at the Jackson Hole Global Central Bank Annual Meeting. The speech immediately attracted high market attention because he hinted that the Fed might start cutting interest rates in September. U.S. stocks immediately surged, and investor sentiment instantly warmed. However, if we carefully analyze the content of the speech, we can find that the implicit risks are far more complex than the market cheers.

Short-term Monetary Policy: From Inflation to Employment

Over the past two years, the Federal Reserve has always prioritized curbing inflation. But this time, Powell turned his attention to the vulnerability of the job market.

He pointed out that both labor supply and demand are slowing down simultaneously: on one hand, tightened immigration policies have led to insufficient labor growth; on the other hand, economic slowdown has suppressed new job creation.

The "dual decline" of supply and demand has created an "unusual fragile balance" that, once broken, could quickly evolve into large-scale layoffs and soaring unemployment. Powell therefore judged that employment risks have exceeded inflation risks, and the Fed must consider cutting rates to buffer the impact.

Inflation Concerns: One-time Shock or Self-reinforcing?

Despite employment being prioritized, the inflation problem remains unresolved. Powell warned that tariff-driven price increases might be just a "one-time shock," but the risk is that such shocks could change the public's long-term inflation expectations, thus evolving into a wage-price spiral: workers demand pay raises due to declining real income; wage increases drive consumption, further pushing up prices; price increases bring another round of pay raise demands.

This cycle would turn one-time price increases into sustained high inflation. Powell emphasized that the Fed would not allow this situation to occur, so even if rates are cut, it would remain cautious.

Historical Warning: 1970s Stagflation

Powell's speech caused concern because the market remembered the stagflation crisis of the 1970s. At that time, the U.S. economy was in a "dual high dilemma" with unemployment at 6.1% and inflation at 5.8%. To win re-election, President Nixon pressured Fed Chairman Burns to cut rates. Burns initially opposed but eventually compromised. In the short term, stocks rose, confidence was boosted, and Nixon was successfully re-elected. However, premature easing fueled inflation, combined with the 1973 oil crisis, U.S. stocks halved within two years, bonds crashed, the dollar fell, and the U.S. fell into a decade-long stagflation - a quagmire of high inflation and economic stagnation.

The horror of stagflation lies in the fact that it puts policy in a dilemma: when inflation is high, tightening is needed, but when the economy stagnates, easing is needed, and both approaches are ineffective. The Fed of the 1970s lost its independence and compromised to political pressure at critical moments, resulting in neither stabilizing employment nor controlling prices.

The current situation creates a strong historical parallel. CPI and PPI data have shown rebounds, money supply has returned to pandemic-era highs, banks are accelerating money creation, and fiscal deficits and debt risks continue to rise. These signs are strikingly similar to half a century ago. The market worries that if the Fed cuts rates too early before inflation is truly under control, the U.S. might repeat the tragedy of the 1970s.

Treasury Market Concerns

Rate cuts don't necessarily mean comprehensive market easing. After the Fed's last consecutive 100 basis point rate cut (September 2024), U.S. long-term Treasury yields rose instead of falling, with increases even exceeding the rate cut magnitude. Behind this is investors' concern about U.S. fiscal deficits and debt sustainability: "The more rate cuts, the more it suggests the U.S. might rely on inflation to digest debt."

When markets worry about "default," they demand higher long-term Treasury yields as compensation. This means that if inflation and fiscal problems are not controlled, rate cuts might instead trigger bond market turmoil.

Long-term Policy Framework: Abandoning "Average Inflation Target"

In addition to short-term policy, Powell also announced long-term framework adjustments. In 2020, the Fed introduced "average inflation targeting," allowing short-term "overshooting" when inflation was low to compensate for past low inflation. But the reality was that once the policy was implemented, U.S. inflation soared to over 9%, making this concept completely ineffective.

Therefore, Powell clearly stated in his speech that the Fed would return to a hard 2% target, no longer emphasizing "average inflation." This is an important strategic correction and shows the Fed's emphasis on policy credibility.

Conclusion: A Cautious Turning Point

Powell's speech at the annual meeting conveyed two key signals:

- September may see a small rate cut (25 basis points) to address employment market risks;

- Long-term framework returns to tradition, abandoning the "average inflation" concept and emphasizing the hard constraint of 2% inflation.

While the market was overjoyed by the rate cut, deeper concerns are brewing: against the backdrop of rebounding inflation, monetary easing, fiscal deficits, and debt risks, will the U.S. return to the stagflation dilemma of the 1970s?

This, perhaps, is Powell's greatest concern.

8月22日,美联储主席鲍威尔在杰克逊霍尔全球央行年会上发表重磅讲话。这场讲话立刻引发市场高度关注,因为他暗示美联储可能将在9月启动降息。美股随即大涨,投资者情绪瞬间转暖。但如果仔细分析讲话内容,可以发现其中隐含的风险远比市场欢呼声更复杂。

短期货币政策:从通胀转向就业

过去两年,美联储始终将抑制通胀作为首要任务。但这一次,鲍威尔将目光转向了就业市场的脆弱性。

他指出,目前劳动力市场供给和需求正在同步放缓:一方面,移民政策收紧,使得劳动力增量不足;另一方面,经济减速压制了新增岗位。

供需"双降"的局面形成了一种"不寻常的脆弱平衡",一旦被打破,可能迅速演变为大规模裁员和失业率飙升。鲍威尔因此判断,就业风险已超过通胀风险,美联储必须考虑降息来缓冲冲击。

通胀担忧:一次性冲击还是自我强化?

尽管就业被置于首位,但通胀问题仍未解决。鲍威尔提醒,关税推动的物价上涨可能只是"一次性冲击",但风险在于这种冲击可能改变公众对通胀的长期预期,从而演变为工资-物价螺旋:工人因实际收入下降要求加薪;工资上涨推动消费,进一步推高物价;价格上涨再度带来新一轮加薪诉求。

这种循环会使一次性的价格上行变成持续性的高通胀。鲍威尔强调,美联储不会允许这种局面发生,因此即便降息,也会保持谨慎。

历史的警示:1970年代的滞胀

鲍威尔的讲话之所以引发忧虑,是因为市场想起了上世纪七十年代的滞胀危机。当时,美国经济正处于失业率 6.1%、通胀 5.8% 的"双高困境"。为了赢得连任,总统尼克松向美联储主席伯恩斯施压要求降息。伯恩斯起初反对,但最终妥协。短期内,股市上涨,信心提振,尼克松顺利连任。然而,过早的宽松为通胀火上浇油,叠加 1973 年的石油危机,美股两年内腰斩,债市暴跌,美元汇率下跌,美国陷入长达十年的滞胀——高通胀与经济停滞并存的泥潭。

滞胀的可怕之处在于,它让政策陷入两难:通胀高企时需要紧缩,但经济停滞又需要宽松,两种手段都无解。七十年代的美联储因为丧失独立性,在关键时刻妥协于政治压力,结果既没稳住就业,也没控制物价。

如今的局面让人产生强烈的历史对照。CPI、PPI 数据已出现反弹,货币供应量回升到疫情时期的高位,银行创造货币的速度加快,财政赤字与国债风险不断上升。这些迹象与半个世纪前惊人相似。市场担心,如果美联储在通胀尚未真正受控时过早降息,美国可能重演七十年代的悲剧。更令人不安的是,特朗普正在通过人事调整逐渐强化对美联储的影响力,鲍威尔也承受着来自白宫的巨大压力。如果货币政策再度沦为短期政治利益的工具,即便短期降息刺激了股市,长期却可能为高通胀和市场动荡埋下隐患。历史已经告诉我们,当美联储失去独立性时,代价往往不是一时的波动,而是深层次的系统性危机。

国债市场的隐忧

降息并不一定意味着市场全面宽松。上一次(2024年9月)美联储连续降息100个基点后,美国长期国债收益率不降反升,涨幅甚至超过降息幅度。这背后是投资者对美国财政赤字和债务可持续性的担忧:"降息越多,越说明美国可能靠通胀来消化债务。"

当市场担心"赖账",他们会要求更高的长期国债收益率作为补偿。这意味着,如果通胀和财政问题得不到控制,降息反而可能引发债市的动荡。

长期政策框架:取消"平均通胀目标"

除了短期政策,鲍威尔还宣布了长期框架调整。2020年,美联储曾引入"平均通胀目标",允许在通胀偏低时,短期"超调"以弥补过去的低通胀。但现实是,政策一出,美国通胀便飙升至9%以上,令这一理念彻底失效。

因此,鲍威尔在讲话中明确,美联储将回归2%的硬目标,不再强调"平均通胀"。这是一次重要的战略修正,也显示出美联储对政策公信力的重视。

结语:谨慎的转折点

鲍威尔在年会上的讲话传递出两个关键信号:

- 9月可能小幅降息(25个基点),以应对就业市场风险;

- 长期框架回归传统,放弃"平均通胀"概念,强调通胀2%的硬约束。

市场对降息喜出望外,但更深层的担忧正在酝酿:在通胀回升、货币宽松、财政赤字和债务风险交织的背景下,美国是否会重返70年代的滞胀困境?

这,或许才是鲍威尔心中最大的忧虑。

Tech Frenzy and Stock Market Bubble 科技狂热与股市泡沫

July 27, 2025 - Market analysis on tech mania and valuation concerns 2025年7月27日 - 科技狂热与估值担忧的市场分析

Click to expand analysis 点击展开分析

This week, a chart ignited Wall Street's alert.

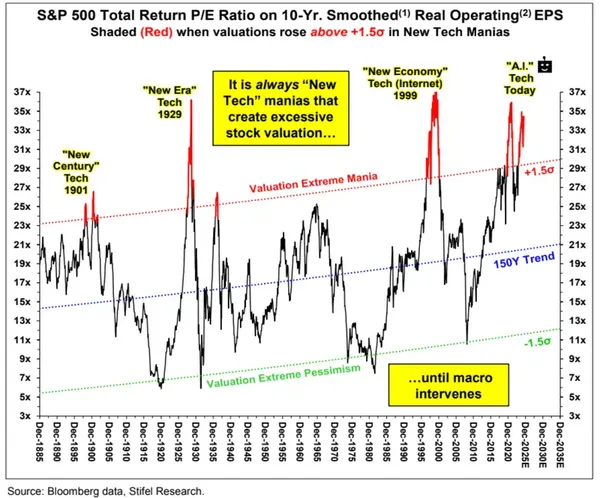

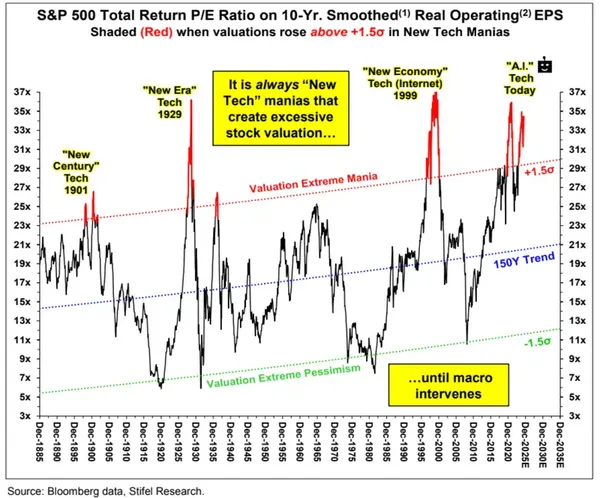

Source: Stifel Research - S&P 500 10-year smoothed P/E ratio

This chart comes from Stifel Research, showing that the S&P 500's 10-year smoothed P/E ratio has approached historical extremes, second only to the peak of the 2000 internet bubble. Every time it touches the red alert line of "+1.5 standard deviations," there stands a familiar figure behind it - "new tech fever."

From the "new century" industrial technology of 1901, to the "radio + automobile" era of 1929, to the "new economy" internet bubble of 1999, now it's AI's turn.

The chart is marked with eye-catching yellow: "It is always 'New Tech' manias that create excessive stock valuation... until macro intervenes."

Every time valuations spiral out of control, it's accompanied by the feverish imagination of "new technology"; and every time a bubble bursts, it's often triggered by macroeconomics, interest rates, credit, or geopolitics.

We are entering a period when macro variables are densely appearing.

Multiple Institutions Issue "Market Bubble" Warnings

Bank of America strategist Hartnett: Global policy rates have dropped from 4.8% to 4.4% over the past year, and are expected to drop to 3.9% in the next year. Against the backdrop of falling interest rates + regulatory relaxation + encouraging retail investors to enter the market, "bubble risks are re-accumulating." Hartnett warns: "More retail investors means more liquidity, more volatility, and bigger bubbles."

Goldman Sachs strategy team: Some market sentiment indicators have soared to extreme levels comparable to the 2000 internet bubble and the 2021 meme stock frenzy. Particularly stocks with high short positions have surged 60% in just a few weeks, with the short-covering wave making the rally even more intense.

Deutsche Bank strategist Caprio: U.S. stock margin debt has broken through $1 trillion, with a single-month increase of 18.5% in June alone, approaching the speed of 1999 and 2007.

Arguments That the Real Bubble Hasn't Formed Yet

Some argue that the real bubble hasn't formed yet, but risks are accumulating. The reasons are as follows:

The Fed hasn't officially cut rates yet: Historically, real valuation bubbles often appear after rate cuts, when money becomes cheaper and speculative enthusiasm intensifies. Currently, while rate cut expectations are heating up, they haven't materialized yet.

Margin debt hasn't hit new highs: Looking at historical trends, before every major bubble burst, margin debt would break through previous highs. Currently, this indicator is only "approaching" and hasn't reached extremes yet.

Bubble concentrated in big tech, broad valuations still reasonable: Currently, the index is mainly driven by a few AI leading stocks, while many small and mid-cap stocks still have P/E ratios in reasonable ranges (15-16x). Only when small and mid-cap valuations are generally pushed up will systemic risks truly form.

VIX volatility at low points, hedging costs extremely low: Multiple investment banks remind clients to buy protective options during the "calm period." For example, Goldman Sachs and Citadel recommend clients configure August-expiring put options to cope with sudden risk events.

Conclusion

Bubbles are born in optimism, expand in loose conditions, prosper in narratives, and then collapse with a bang at the moment when some macro variable quietly changes.

Today's market is stuck in the stage where "the narrative sounds most appealing."

本周,一张图点燃了华尔街的警觉。

来源:Stifel Research - S&P 500 10年平滑市盈率

这张图来自Stifel Research,图示:S&P 500 的10年平滑市盈率(P/E Ratio)已逼近历史极值,仅次于 2000 年互联网泡沫巅峰时期。而每一次触及红色警戒线"+1.5 标准差",背后都站着一个熟悉的身影——"新科技热潮"。

从 1901 年的"新世纪"工业技术,到 1929 年的"无线电+汽车"时代,再到 1999 年的"新经济"互联网泡沫,如今轮到了 AI。

图上用醒目的黄色标注:"It is always 'New Tech' manias that create excessive stock valuation... until macro intervenes."

每一次估值的失控上涨,都伴随着"新科技"的狂热想象;而每一次泡沫的破裂,往往都由宏观经济、利率、信贷或地缘政治触发。

我们正在进入一个宏观变量密集登场的时期。

多个机构陆续发出"市场泡沫"预警

美银策略师 Hartnett:全球政策利率过去一年从 4.8% 降到 4.4%,预计未来一年还将降至 3.9%。在利率下行 + 监管放松 + 鼓励散户入市的背景下,"泡沫风险正在重新积聚"。Hartnett 警告:"散户多,流动性就多,波动就大,泡沫也大。"

高盛策略团队:一些市场情绪指标已经飙升至与 2000 年互联网泡沫、2021 年 meme 股狂潮相当的极值水平。特别是空头仓位高的股票,在几周内大涨 60%,回补潮让行情更加剧烈。

德银策略师 Caprio:美股融资杠杆已突破 1 万亿美元,仅 6 月一月内涨幅就高达 18.5%,速度接近 1999 和 2007 年。

有观点认为,真正的泡沫尚未形成,但风险正在积聚

理由如下:

美联储还没正式降息:历史上真正的估值泡沫往往出现在降息之后,钱变得更便宜,投机热情才会加剧。当前虽然降息预期升温,但尚未落地。

融资余额尚未创新高:从历史走势来看,每一次重大泡沫破裂前,融资余额都会突破前高。目前这一指标还只是"接近",尚未出现极端。

泡沫集中于大科技,广泛估值仍合理:目前推动指数的主要是少数 AI 龙头股,许多中小盘股票市盈率依旧处于合理区间(15-16 倍)。只有当中小盘估值普遍推高,系统性风险才真正形成。

VIX波动率处于低点,对冲成本极低:多家投行提醒客户趁"平静期"买入保护性期权。例如高盛和 Citadel 建议客户配置8月到期的看跌期权,以应对突发风险事件。

结语

泡沫,诞生于乐观,扩张于宽松,繁荣于叙事,然后在某个宏观变量悄然改变的时刻,轰然坍塌。

如今的市场,正停留在"叙事最动听"的阶段。

Trump's Strategic Blueprint: Complete Analysis of "Government Efficiency + Capital State" Economic Policy 川普的战略蓝图:"政府效率 + 资本国家"经济政策全解读

March 22, 2025 - Comprehensive analysis of Trump's economic policy framework 2025年3月22日 - 川普经济政策框架全面分析

Click to expand analysis 点击展开分析

Trump has been re-elected as President of the United States for two months now. As investors, or even just ordinary consumers, we are beginning to feel more deeply: the policy direction has really changed. However, if you only piece together clues from news headlines, it's difficult to see what this administration really wants to do. Tariffs, fiscal deficits, manufacturing reshoring, tax cuts... each issue affects the whole, and the media often only provides fragmentary information, unable to outline a complete strategy.

Recently, Silicon Valley's most influential investment podcast All-In Podcast interviewed two core economic figures from the Trump administration - Treasury Secretary Bessent and Commerce Secretary Luttig. The two interviews totaled over 3 hours, covering a complete vision from trade and taxation to national finance. This is the first time we can hear such a systematic explanation from the strategic planners of the Trump team themselves.

Fundamental Shift in Trade Philosophy: From "Free Market" to "National Sovereignty First"

In the interview, Commerce Secretary Luttig described a deep reflection on the current global trade landscape.

He pointed out that America's current low-tariff policy is not a historical norm, but stems from a strategic choice to rebuild the global order after World War II. To help post-war devastated countries recover, the United States actively lowered tariffs, becoming a buyer of global goods while allowing other countries to maintain high tariffs. This arrangement played an important role under the Cold War structure, but in today's reshaping of the global economic landscape, obvious asymmetries have begun to emerge. The United States remains the country with the lowest tariffs globally, yet suffers from manufacturing and job losses. Trump detected this as early as the 1980s, advocating for trade balance restoration through tariff increases.

He proposed that tariffs have two key functions:

- Protect domestic manufacturing and promote industrial reshoring: Tariffs increase import prices, thereby enhancing the price competitiveness of domestic products and stimulating companies to relocate production lines back to the United States. This strategy has shown initial results, with major investment projects from TSMC, Apple, and others landing in the United States.

- Government revenue generation to alleviate fiscal deficits: Beyond industrial significance, Luttig also emphasized that tariffs are one of the "government revenue tools" to make up for fiscal gaps and replace traditional tax pressure.

Fiscal Deficit Solution: Sovereign Fund + Immigration Gold Card + Revenue Enhancement and Cost Reduction

When discussing how to solve America's serious fiscal deficit problem, Luttig proposed a combination approach:

- Increase fiscal revenue by $100 billion through tariffs

- Establish a sovereign fund to invest in key enterprises with government credit

- Launch an "Investment Gold Card" to attract high-net-worth immigrants

- Compress federal spending and improve government efficiency

Particularly noteworthy is the "Immigration Gold Card" concept: foreigners only need to invest $5 million to obtain U.S. residency rights without becoming citizens, thus avoiding global taxation. Luttig estimates that at least 37 million people globally qualify, and if 1 million people are successfully attracted to enter, it will bring $5 trillion in direct revenue.

The so-called "sovereign fund" would integrate long-dormant assets such as Fannie Mae, energy assets, and federal lands by the U.S. government for market-oriented operation to obtain sustained returns. Such operations have mature experience in countries like Norway and Singapore.

Government Reform and Tax Cut Vision: Returning to a "Small and Efficient" Government

Government efficiency reform is the part that both ministers emphasized most.

Luttig pointed out that the federal government currently has approximately 2.1 million non-military, non-postal civilian employees, but only 450,000 are defined as "essential personnel," indicating significant redundancy within the system. He believes that this large and inefficient government structure not only burdens finances but also leads to resource misallocation and slow decision-making, becoming an "invisible shackle" on U.S. economic vitality. He advocates establishing a "Government Efficiency Department" to comprehensively assess government employee structure and spending through technological means (such as AI-assisted auditing and performance data tracking), identifying positions that can be restructured, optimized, or even eliminated. The goal is to save $1 trillion in annual expenditures, inject vitality into national finances, and create space for tax cuts and industrial investment.

Bessent further pointed out that America's problem is not insufficient revenue but uncontrolled spending. Budget inflation, project overlap, and inefficient resource allocation are consuming public wealth. He hopes to eliminate federal income tax for income groups below $150,000 based on completing spending reform, achieving substantial relief. He believes this policy will significantly increase disposable income for middle-class and young families, enhance labor incentives, and promote consumption and investment, forming a virtuous economic cycle.

Energy, Regulation, and Tax Reform: Building Growth Engines

Bessent proposed another key framework for the Trump administration's economic policy in the interview - the "3-3-3 Strategy," reconstructing America's growth engine through three core indicators:

- Achieve 3% annual GDP growth rate

- Compress fiscal deficit as a percentage of GDP to within 3%

- Add 3 million barrels of daily crude oil production to promote energy independence

He believes these three indicators are not just goals but a strategic system that supports and conditions each other.

Strategic Clarity, But Implementation Challenges: Three Major Real-World Tests for Trump's Economic Blueprint

Although Luttig and Bessent proposed many refreshing economic concepts in these two three-hour interviews, from taxation and finance to energy and sovereign funds, all showing the "systematic reconstruction" that the Trump administration's second term seeks to promote, this strategic blueprint still has several key "gaps" that cannot be ignored.

First, they did not directly address the potential input inflation problems that tariffs might trigger. In today's highly interconnected global supply chain context, increasing import costs will inevitably be transmitted to the consumer side, affecting prices and people's purchasing power. Whether this impact can be completely offset by tax cuts and GDP growth remains unknown.

Second, retaliatory countermeasures from other countries were not deeply discussed. If large-scale tariff imposition is seen as trade provocation, could it trigger a new round of trade wars? Could it have negative impacts on U.S. exports, cross-border capital flows, and global investment confidence? These risks have not been clearly addressed.

Finally, although both houses of Congress are currently controlled by Republicans, theoretically providing political conditions for policy advancement, this does not mean all strategies can be smoothly implemented. Issues such as tax reform, sovereign fund establishment, and fiscal restructuring may still face hesitation from moderate party members, resistance from local interest groups, or concerns from budget hawks about deficits. Moreover, certain reforms (such as institutional streamlining and energy policy deregulation) in actual implementation will involve legal procedures, state-level cooperation, and federal civil service system backlash. Therefore, even though the "legislative channel" appears to be open, truly implementing each systematic reform remains a severe test of administrative coordination, political integration, and public communication capabilities.

From the current perspective, the Trump administration's economic strategy is more like a "draft" than a "construction blueprint" - logically consistent and directionally clear, but still has a long political path to full implementation.

However, whether you support it or not, this "draft" at least allows us to systematically understand the Trump team's thinking and policy combinations in areas such as trade, finance, taxation, and immigration for the first time. They are indeed no longer just slogans but are planning a strong economic state vision based on "government efficiency + capital operation."

As investors, business owners, or even ordinary family financial planners, whether we agree with these strategies or not, we must understand them. Because the direction of these policies - whether successful or not - will profoundly affect the evolution of financial markets, macroeconomics, and even international patterns in the coming years.

川普已经再次就任美国总统两个月了。作为投资者,或者哪怕只是一个普通的消费者,我们都开始更深刻地感受到:政策风向真的变了。不过,如果你只从新闻头条里拼凑线索,很难看清这届政府真正想做什么。关税、财政赤字、制造业回流、减税……每个议题都牵一发而动全身,媒体往往只给出片段信息,无法勾勒出完整战略。

最近,硅谷最有影响力的投资播客 All-In Podcast,连线了两位川普政府的经济核心人物——财政部长贝森特(Bessent) 和 商务部长卢特尼克(Luttig)。两场采访加起来超过3小时,涵盖了从贸易、税收到国家财政的完整设想,是我们第一次能从川普团队战略制定者本人口中,听到这么系统的阐述。

贸易观的根本转变:从"自由市场"到"国家主权优先"

在采访中,商务部长卢特尼克讲述了对现行全球贸易格局的深层反思。

他指出,美国当前的低关税政策并非历史常态,而是源于二战后重建全球秩序的战略选择。为了帮助战后百废待兴的国家复苏,美国主动降低关税,成为全球商品的买家,同时允许其他国家维持高关税。这一安排曾在冷战格局下发挥重要作用,但在全球经济格局重塑的今天,已经开始出现明显不对称。美国现在仍是全球关税最低的国家,却反而在制造业与就业方面遭遇流失。川普早在上世纪80年代就敏锐察觉到这一点,主张通过加征关税来恢复贸易平衡。

他提出关税有两个关键作用:

- 保护本土制造业,促进产业回流:关税提高了进口商品价格,从而提升本土产品的价格竞争力,刺激企业将生产线迁回美国。这一策略已初见成效,台积电、苹果等重大投资项目正在美国落地。

- 政府创收,缓解财政赤字:除了产业意义,卢特尼克还强调关税是"政府收入工具"之一,用以弥补财政缺口,替代传统税收压力。

财政赤字方案:主权基金 + 移民金卡 + 开源节流

谈及如何解决美国严重的财政赤字问题,卢特尼克提出一套组合拳:

- 通过关税增加1000亿美元财政收入

- 设立主权基金,以政府信用投资关键企业

- 推出"投资金卡",吸引高净值移民

- 压缩联邦开支,提升政府效率

特别值得关注的是"移民金卡"构想:外国人只要投资500万美元,即可获得美国居住权,但无需成为公民,从而避开全球征税。卢特尼克预计,全球至少有3700万人符合资格,若成功吸引100万人入境,将带来5万亿美元的直接收入。

而所谓"主权基金",则是由美国政府将房利美、能源资产、联邦土地等长期沉睡资产整合起来,市场化运作,获取持续回报。这类操作在挪威、新加坡等国已有成熟经验。

政府改革与减税愿景:回归"小而精"的政府

政府效率改革,是两位部长都着墨最多的部分。

卢特尼克指出,联邦政府现有非军事、非邮政的文职雇员,大约是 210万人,但真正被定义为"不可或缺"(essential personnel)的仅有45万人,说明系统内存在大量冗余。他认为,这种庞大而低效的政府架构,不仅拖累财政,更导致资源错配、决策缓慢,已经成为美国经济活力的"隐形桎梏"。他主张设立"政府效率部门",通过科技手段(如AI辅助审计、绩效数据跟踪)全面评估政府雇员结构与开支,识别出可被重组、优化甚至取消的岗位。目标是每年节省 1万亿美元的支出,为国家财政注入活水,并为减税和产业投资腾出空间。

贝森特则进一步指出,美国的问题不是收入不足,而是支出失控。预算膨胀、项目重叠和资源低效配置,正在吞噬公共财富。他希望在完成开支改革的基础上,取消15万美元以下收入群体的联邦所得税,实现实质性减负。他认为这项政策将大幅提升中产阶层和年轻家庭的可支配收入,增强劳动激励,同时推动消费和投资,从而形成经济良性循环。

能源、监管与税制改革:打造增长引擎

贝森特在采访中提出了川普政府经济政策的另一个关键框架——"3-3-3战略",通过三项核心指标,重构美国经济的增长引擎:

- 实现3%的GDP年增长率

- 将财政赤字占GDP的比例压缩至3%以内

- 每日新增原油产量300万桶,推动能源独立

他认为,这三项指标不仅仅是目标,而是彼此支撑、互为条件的战略体系。

战略清晰,但落地未易:川普经济蓝图的三大现实考验

尽管卢特尼克与贝森特在这两场长达三小时的访谈中提出了不少耳目一新的经济构想,从税收、财政到能源和主权基金,都展现出川普政府第二任期试图推动的"系统性重构",但这套战略蓝图仍存在几个关键的"留白",无法忽视。

首先,他们并未正面回应关税可能引发的输入型通胀问题。在当今全球供应链高度互联的背景下,提高进口成本势必会传导到消费端,影响物价和民众购买力。这种影响是否能完全被减税和GDP增长抵消,仍是个未知数。

其次,其他国家的报复性反制也未被深入讨论。如果大规模征收关税被视为贸易挑衅,是否可能引发新一轮贸易战?是否会对美国出口、跨国资本流动和全球投资信心产生负面冲击?这些风险尚未有清晰交代。

最后,虽然当前国会两院均由共和党掌控,理论上为政策推进提供了政治条件,但这并不意味着所有战略都能顺利落地。税改、主权基金设立、财政重组等议题仍可能面临党内温和派的犹豫、地方利益集团的抗拒,或预算鹰派对赤字的担忧。更不用说某些改革(如机构精简、能源政策松绑)在实际执行中,还会牵涉到法律程序、州层级合作以及联邦公务员体系的反弹。因此,即便从表面上看"立法通道"已经打开,真正走通每一项系统性改革,依旧是对行政协调、政治整合和公众沟通能力的严峻考验。

从目前来看,川普政府的经济战略更像是一份"底稿"而非"施工图"——逻辑自洽,方向明确,但距离全面执行仍有漫长的政治路径要走。

不过,无论你支持与否,这份"底稿"至少让我们第一次得以系统性地理解川普团队在贸易、财政、税收、移民等领域的思维方式和政策组合。他们确实不再只是口号,而是在谋划一种以"政府效率+资本运作"为基础的强势经济国家愿景。

作为投资者、企业主,甚至普通的家庭财务规划者,无论我们是否认同这些战略,但必须理解它们。因为这些政策的走向——无论成败——都将在未来几年内深刻影响金融市场、宏观经济乃至国际格局的演变方向。

The Ghost of Tariffs: From Historical Precedents to Contemporary Crisis 关税的幽灵:从历史覆辙到当代危机

March 13, 2025 - Historical analysis of tariff policies and their consequences 2025年3月13日 - 关税政策及其后果的历史分析

Click to expand analysis 点击展开分析

When the rules of global trade are torn apart, where will the future of the economy lead? Trump's tariff storm has once again plunged the world into tension, and historical lessons tell us that the cost of trade protectionism is often heavier than imagined.

1930s: Tariff Barriers and Global Conflict

In 1930, U.S. President Hoover implemented high tariff policies, and the global economy rapidly deteriorated. 23 countries immediately accelerated their arms race, and global trade suffered heavy losses. Japan's exports were halved within a year, and as a country dependent on imports and exports, it almost lost all possibility of economic self-rescue. With the domestic economy on the verge of collapse, militaristic ideology rapidly rose, and extreme nationalists seized power, implementing foreign expansion policies. Just five months later, the September 18th Incident broke out, and the shadow of war gradually enveloped the globe.

Germany was not spared either. Two years after Hoover's tariff policy was implemented, Germany's unemployment rate soared, with 6 million unemployed people flooding the streets. In 1933, the Nazi Party rapidly rose with the help of economic crisis anger, and Hitler promised to revive Germany through expansion policies, controlling the entire territory within a few years. When Britain, France, and the United States tried to renegotiate trade agreements, Berlin, Rome, and Tokyo had already begun dividing the world map. Finally, World War II broke out in full force in 1939.

Economists wrote this sentence on the back of Nazi war criminal death warrant newspapers: "When tariffs become weapons, bullets become votes."

Tariff Wars in American History

Tariff issues have repeatedly triggered major conflicts in American history.

In 1828, the U.S. Congress passed a high tariff law to protect Northern manufacturing, and European countries immediately retaliated, severely damaging Southern agricultural exports, ultimately leading to the outbreak of the Civil War.

In 1890, the United States raised tariffs again, causing industrial product costs to soar and triggering the Panic of 1893, with more than 15,000 enterprises and 500 banks going bankrupt.

In 1929, the global economic crisis broke out, and the United States mistakenly believed that imposing tariffs could protect domestic industries, ultimately leading to global trade collapse. By 1933, U.S. exports had plummeted by 85%, and the global economy was deeply mired in the Great Depression.

At that time, Ford Motor founder, Morgan consortium, and other entrepreneurs had desperately tried to dissuade President Hoover from signing the Smoot-Hawley Tariff Act, but ultimately failed to prevent the disaster.

When trade protectionism becomes national policy, nationalism and extreme politics begin to stir. In the 1930s, fascist regimes in Germany, Japan, and Italy rose successively, with economic difficulties transforming into military expansion, ultimately leading to the full outbreak of World War II.

The Hidden Costs of Tariffs

Modern economic research shows: The delayed costs of free trade will be converted into war costs at a geometric multiple. Taking the United States as an example, every large-scale tariff adjustment is accompanied by domestic economic turmoil, even affecting the global landscape.

After World War II, countries around the world learned their lessons and promoted global trade liberalization by establishing the Bretton Woods system, most-favored-nation treatment, and other international mechanisms, reducing the global average tariff level from 40% in 1947 to about 9% in recent years. This system maintained 80 years of relative peace and economic prosperity after the war.

However, today's international situation is repeating historical mistakes. Trump and his team are vigorously promoting trade protectionism, trying to redefine the global economic order. The paralysis of the WTO Appellate Body and the increasing global trade barriers have put the post-war peace and growth dividends in jeopardy.

Historical Mirror

In 1934, the Roosevelt administration discovered a chilling statistic:

"For every 1% increase in U.S. tariffs, Germany's military spending grew by 2.3%, and Japan's military budget rose by 1.8%."

This data vividly demonstrates the close connection between tariffs and arms races.

Today, we are at a critical juncture concerning future direction. If the free trade system continues to be destroyed, the costs of economic crisis and war will become increasingly high. When globalization is torn apart, confrontation between countries will only intensify, ultimately potentially leading to conflict.

Conclusion: The Delayed Costs of Free Trade

History repeats itself, and economists have summarized a cruel but realistic rule: The later free trade is restored, the higher the costs of war and depression. Today's trade war, while not yet at the level of global economic collapse, if countries continue to implement protectionist policies, the fragmentation of global markets, the breakdown of supply chains, and the slowdown of economic growth may become the main theme of the next few years.

Trade wars are not a zero-sum game, but a contest where everyone gets hurt. Will the future global economy move toward cooperation and win-win, or fall into confrontation and recession again? Let's wait and see.

当全球贸易的规则被撕裂,经济的未来将走向何方?特朗普的关税风暴再次让世界陷入紧张,而历史的教训告诉我们,贸易保护主义的代价往往比想象中更为沉重。

1930年代:关税壁垒与全球冲突

1930年,美国总统胡佛推行高关税政策,全球经济迅速恶化。23个国家立即加速军备竞赛,全球贸易遭受重创。日本出口量一年内腰斩,作为一个依赖进出口的国家,几乎失去了所有经济自救的可能性。在国内经济濒临崩溃的情况下,军国主义思潮迅速崛起,极端民族主义者掌握政权,推行对外扩张政策。仅五个月后,918事变爆发,战争的阴影逐步笼罩全球。

德国也未能幸免。胡佛关税政策实施两年后,德国失业率飙升,600万失业者涌入街头。1933年,纳粹党借助经济危机的愤怒情绪迅速崛起,希特勒通过扩张政策许诺复兴德国,在短短几年内掌控全境。当英、法、美试图重新制定贸易协定时,柏林、罗马、东京早已开始划分世界版图。最终,二战在1939年全面爆发。

经济学家在纳粹战犯的死刑令报纸背面写下这样一句话:"当关税成为武器时,子弹就会变成选票。"

美国历史中的关税战争

关税问题在美国历史上屡次引发重大冲突。

1828年,美国国会通过保护北方制造业的高关税法,欧洲各国立即进行反制,南方农业出口受到重创,最终导致南北战争爆发。

1890年,美国再次提高关税,工业产品成本飙升,引发1893年大恐慌,超过15,000家企业和500家银行破产。

1929年,全球经济危机爆发,美国错误地认为加征关税能保护国内产业,最终导致全球贸易崩溃。到1933年,美国出口额暴跌85%,全球经济深陷大萧条。

当年,福特汽车创始人、摩根财团等企业家曾极力劝阻胡佛总统签署斯穆特-霍利关税法案,但最终未能阻止灾难的发生。

当贸易保护主义成为国家政策,民族主义和极端政治便开始蠢蠢欲动。1930年代,德国、日本、意大利法西斯政权相继崛起,经济困境转化为军事扩张,最终导致二战全面爆发。

关税的隐形成本

现代经济研究表明:自由贸易的延迟成本将以几何倍数转化为战争代价。以美国为例,每一次大规模关税调整,都伴随着国内经济动荡,甚至影响全球格局。

二战结束后,世界各国汲取教训,通过建立布雷顿森林体系、最惠国待遇等国际机制,推动全球贸易自由化,使全球关税平均水平从1947年的40%下降至近年的9%。这一体系维持了战后80年相对和平与经济繁荣。

然而,如今的国际局势正在重蹈历史覆辙。特朗普及其团队正大力推动贸易保护主义,试图重新定义全球经济秩序。WTO上诉机构的瘫痪、全球贸易壁垒的不断增加,使得二战以来的和平增长红利岌岌可危。

历史的镜鉴

1934年,罗斯福政府发现了一个令人不寒而栗的统计数据:

"美国关税每提高1%,德国军费支出就增长2.3%,日本军费预算则上升1.8%。"

这一数据直观展现了关税与军备竞赛之间的密切联系。

如今,我们正处在一个关乎未来走向的关键节点。如果自由贸易体系继续被破坏,经济危机与战争的成本将越来越高。当全球化被撕裂,国家间的对抗只会加剧,最终可能导致冲突的爆发。

结语:自由贸易的延迟成本

历史不断重演,经济学家总结出一条残酷但现实的规律:自由贸易越晚恢复,战争与萧条的成本就越高。今天的贸易战虽然还未到全球经济崩溃的地步,但如果各国继续推行保护主义政策,全球市场的分裂、供应链的断裂、经济增长的放缓,可能成为未来几年的主旋律。

贸易战不是一场零和游戏,而是一场所有人都会受伤的较量。未来的全球经济,究竟是走向合作共赢,还是再次陷入对抗与衰退?让我们拭目以待。

Trump's Economic Gamble: Can the Mar-a-Lago Deal Save America's Debt Crisis? 特朗普的经济豪赌:海湖庄园协议能否拯救美国债务危机?

March 8, 2025 - Analysis of Trump's economic strategy and debt crisis management 2025年3月8日 - 特朗普经济策略与债务危机管理分析

Click to expand analysis 点击展开分析

Recently, global markets have undergone dramatic changes, with U.S. stocks falling sharply and investor confidence plummeting. The market generally expects the government to introduce policies to stabilize the market. However, U.S. Treasury Secretary Bessent recently made it clear that the White House's focus has shifted from the stock market to debt issues. He bluntly stated: "Investors who expect the president to step in to stop the stock market decline may be disappointed." This means that even if the market falls sharply, the government will not take excessive intervention measures, and the "stock market protection policies" previously expected by the market have been completely negated.

Currently, what the U.S. government is most concerned about is not the stock market, but U.S. Treasury bonds. Currently, the total U.S. debt has climbed to $36.5 trillion and is growing at an alarming rate. To alleviate debt pressure, the government has taken a series of measures, including imposing tariffs, reducing fiscal spending, and adjusting immigration policies. The market speculates that Trump may hope to use market volatility to suppress Treasury bond yields, thereby reducing debt costs. Whether this strategy is effective remains to be seen. But obviously, this has caused further impact on market confidence.

The highly anticipated "Mar-a-Lago Agreement" may become a key turning point in the adjustment of the global financial landscape.

Mar-a-Lago Agreement: A Turning Point in Global Financial Landscape?

Looking back at history, the Bretton Woods system (1944) established the U.S. dollar's status as the global reserve currency and laid the foundation for the post-war international financial order; the Plaza Accord (1985) promoted the appreciation of the yen and mark through multi-country cooperation to reduce the U.S. trade deficit. The Trump 2.0 administration is trying to reshape America's dominant position in the global economy through unilateral economic policy adjustments via the "Mar-a-Lago Agreement."

The core content of the agreement includes:

- Dollar Depreciation: The Trump administration hopes to enhance export competitiveness and reduce import dependence through dollar depreciation. This strategy, combined with tariff policies, will further push up import costs and stimulate domestic manufacturing reshoring.

- Debt Restructuring: The United States plans to convert foreign-held U.S. debt into ultra-long-term zero-interest bonds to reduce government debt burden. This model is similar to China's local government debt swap strategy, but market acceptance is questionable.

- Tariff Reform: The Trump administration is trying to use tariff policies as international negotiation tools, adjusting tax rates based on trade negotiation progress to promote the reshaping of global trade rules. This is not only to reduce the U.S. trade deficit but also to force major economies to accept dollar depreciation policies, creating a more favorable financial environment for the United States.

If this agreement is implemented, global financial markets will usher in a new round of turmoil. International investors have begun to worry whether the Trump administration's economic policies will ultimately trigger a global economic recession like the 1930s.

Historical Lessons: Hoover Administration's Policy Mistakes Exacerbated the Great Depression

In 1929, the U.S. stock market crashed and the global economy fell into the Great Depression. Facing the economic crisis, then U.S. President Hoover proposed a series of policies to try to reverse the situation, including: deporting immigrants to preserve domestic job opportunities; raising tariffs to block foreign goods; domestic tax cuts to stimulate industrial recovery.

In 1930, the United States passed the Smoot-Hawley Tariff Act, significantly raising import tariffs in an attempt to boost the domestic economy. However, this move triggered retaliatory tariffs from other countries, causing global trade to shrink dramatically and further deepening the economic crisis. At the same time, the Hoover administration intensified immigration deportation to reduce competition and protect American workers' employment, but the sudden contraction of the labor market instead hindered economic recovery. In addition, domestic tax cut policies failed to effectively stimulate consumption, corporate confidence continued to decline, and the economy fell into a deeper quagmire.

High unemployment and economic depression bred social discontent, and extreme political forces and populism rose in multiple countries, ultimately pushing the world toward the abyss of war.

Trump's Trade Protection and Fiscal Austerity: Historical Repetition or New Strategy?

Looking back at history, the combination of trade protectionism and fiscal austerity often exacerbates economic crises. However, the Trump 2.0 administration has chosen a path similar to the Hoover administration in many aspects: strengthening trade barriers, tightening immigration policies, and implementing fiscal austerity to deal with America's ever-rising government debt.

But the difference is that the Trump administration is not passively responding to the deficit crisis, but actively using these measures to pressure the Federal Reserve to cut interest rates and alleviate the debt crisis.

Unlike the private debt crisis of the 1930s, today's core problem lies in the interweaving of uncontrolled government debt and high leverage in corporate debt and private credit markets, with risks far exceeding those of that era. Currently, U.S. government debt has climbed to $36 trillion, accounting for more than 120% of GDP, while in the 1930s it was only about 20%. Rising interest rates have increased the government's debt interest burden. Former Lehman Brothers trader and Bear Traps Report founder Larry McDonald pointed out that if interest rates remain at current levels, U.S. debt interest next year will reach $1.2 to $1.3 trillion, exceeding defense spending.

Facing this serious debt pressure, the Trump administration is trying to reshape global financial rules through the Mar-a-Lago Agreement, with the ultimate goal of alleviating America's debt crisis. Fiscal austerity has become a key means for the government to reduce fiscal deficits, led by DOGE (Department of Government Efficiency), with government spending significantly reduced, especially in social welfare, education, and non-defense areas. At the same time, the combination of fiscal austerity and trade barriers will increase economic uncertainty and further prompt the Federal Reserve to cut interest rates to reduce debt interest expenses.

The Trump administration hopes to reduce debt burden through this strategy without actively defaulting. However, this strategy carries extremely high risks. If market expectations get out of control, dollar depreciation may evolve into capital flight, with investors massively selling U.S. bonds, triggering violent turmoil in global financial markets. Whether the Trump administration can successfully navigate this strategy depends on market confidence in U.S. bonds and the Federal Reserve's future policy responses.

The Embryo of a New Cold War? The World is Entering a More Confrontational Era

The Trump administration's economic policies not only cause turmoil at the market level but also reshape the global political landscape, affecting the balance of power between countries. Fiscal austerity and trade wars may further exacerbate social discontent, intensify domestic political confrontation, and weaken government governance capabilities. At the international level, global supply chain restructuring not only intensifies economic friction but may also become a new battlefield for policy games between countries, promoting the escalation of geopolitical tensions.

In the 1930s, trade protectionism, economic recession, and extreme politics intertwined, ultimately dragging the world into the abyss of war. Today, similar signals are appearing again: trade barriers rising, economic confrontation between countries escalating, populism rising...

History always carries similar rhymes, making people look back at the past, trying to find inspiration for the future. But despite the uncertainty in the global situation, history will not simply repeat itself.

Today's world has more balancing mechanisms than the 1930s, global economic ties remain close, and the deterrent power of nuclear weapons makes the cost of large-scale war far higher than in the past. Although local conflicts may intensify, the possibility of a direct outbreak of world war is very low.

The fragmentation of the global economy is evolving from short-term conflicts to long-term trends. In recent years, U.S.-China tech decoupling, supply chain restructuring, and de-dollarization have accelerated, and the global economy is being redefined. The Trump administration's economic policies are accelerating this process, while other major economies are also seeking countermeasures. This economic fragmentation will not change the world overnight like war, but it may bring more far-reaching impacts: reduced global economic cooperation, increased market uncertainty, reduced resource allocation efficiency, slowed economic growth in various countries, and even possible fragmentation of regional financial systems.

The Trump administration's policies will not directly trigger a world war, but they will push the world toward deeper confrontation and fragmentation, forming a "new cold war" style of economic and political confrontation.

近期,全球市场风云突变,美股大幅下挫,投资者信心急剧下滑。市场普遍期待政府出台政策稳定市场。然而,美国财政部长贝森特近日明确表示,白宫的关注重点已从股市转向债务问题。他直言:"那些指望总统出手阻止股市下跌的投资者可能会感到失望。"这意味着,即使市场大幅下跌,政府也不会采取过度干预措施,市场此前期待的"股市保护政策"被彻底否定。

当前,美国政府最关心的并非股市,而是美国国债。目前,美国国债总额已攀升至36.5万亿美元,并以惊人的速度增长。为缓解债务压力,政府采取了一系列措施,包括加征关税、缩减财政支出、调整移民政策等。市场推测,特朗普可能希望利用市场波动来压低国债收益率,从而降低债务成本。这一策略是否有效尚待观察。但显然,这对市场信心造成了进一步冲击。

市场高度关注的"海湖庄园协议",可能成为全球金融格局调整的关键节点。

海湖庄园协议:全球金融格局的转折点?

回顾历史,布雷顿森林体系(1944年)确立了美元的全球储备货币地位,奠定了战后国际金融秩序;广场协议(1985年)则通过多国协作,推动日元和马克升值,以削减美国贸易逆差。特朗普2.0政府试图通过"海湖庄园协议",以单方面的经济政策调整,重塑美国在全球经济中的主导地位。

该协议的核心内容包括:

- 美元贬值:特朗普政府希望通过美元贬值提升出口竞争力,减少进口依赖。这一策略与关税政策叠加,将进一步推高进口成本,刺激本土制造业回流。

- 债务重组:美国计划将外资持有的美债转化为超长期零利率债券,以降低政府债务负担。这一模式类似于中国地方政府的债务置换策略,但市场接受度存疑。

- 关税改革:特朗普政府试图将关税政策作为国际谈判工具,根据贸易谈判进展调整税率,推动全球贸易规则的重塑。这不仅是为了减少美国贸易逆差,更是为了迫使主要经济体接受美元贬值政策,为美国创造更有利的金融环境。

如果该协议落地,全球金融市场将迎来新一轮动荡。国际投资者已开始担忧,特朗普政府的经济政策是否会像1930年代那样,最终引发全球范围的经济衰退。

历史的教训:胡佛政府的政策失误加剧大萧条

1929年,美国股市崩盘,全球经济陷入大萧条。面对经济危机,时任美国总统胡佛提出了一系列政策,试图扭转局势,包括:驱逐移民,以保留本土就业机会;提高关税,以封锁海外商品;国内减税,以刺激工业复苏。

1930年,美国通过《斯穆特-霍利关税法案》,大幅提高进口关税,试图以此提振国内经济。然而,这一举措引发了其他国家的报复性关税,全球贸易急剧萎缩,进一步加深了经济危机。与此同时,胡佛政府加大移民遣返力度,以减少竞争,保障美国工人的就业,但劳动力市场的骤然收缩反而对经济复苏造成阻碍。此外,国内减税政策未能有效刺激消费,企业信心持续下滑,经济陷入更深的泥潭。

高失业率和经济萧条滋生了社会不满,极端政治势力和民粹主义在多个国家崛起,最终推动世界走向战争的深渊。

特朗普的贸易保护与财政紧缩:历史的重演,还是新策略?

回顾历史,贸易保护主义与财政紧缩的结合往往会加剧经济危机。然而,特朗普2.0政府在许多方面仍选择了类似胡佛政府的路径:强化贸易壁垒、收紧移民政策、实施财政紧缩,以应对美国不断攀升的政府债务。

但不同的是,特朗普政府并非被动应对赤字危机,而是主动通过这些措施向美联储施压,以促使降息,缓解债务危机。

与1930年代的私人债务危机不同,今天的核心问题在于政府债务失控和企业债务和私人信贷市场的高杠杆问题相互交织,风险远超当年。当前,美国政府债务已攀升至36万亿美元,占GDP比重超过120%,而1930年代仅为20%左右。利率上升使得政府债务利息负担加重。前雷曼兄弟交易员、Bear Traps Report创始人Larry McDonald指出,如果利率保持在当前水平,明年美国的债务利息将达到1.2万亿到1.3万亿美元,超过国防开支。

面对这一严重的债务压力,特朗普政府试图借助海湖庄园协议重塑全球金融规则,最终目标是缓解美国的债务危机。财政紧缩成为政府削减财政赤字的关键手段,由DOGE(Department of Government Efficiency)主导,政府支出大幅缩减,特别是在社会福利、教育和非国防领域。同时,财政紧缩与贸易壁垒的结合,将增加经济不确定性,进一步促使美联储降息,以降低债务利息支出。

特朗普政府希望通过这一策略,在不主动违约的情况下削减债务负担。然而,这一策略存在极高的风险,如果市场预期失控,美元贬值可能演变为资本外逃,投资者大规模抛售美债,引发全球金融市场的剧烈动荡。特朗普政府能否成功驾驭这一策略,取决于市场对美债的信心,以及美联储在未来的政策应对。

新冷战的雏形?世界正在进入更加对立的时代

特朗普政府的经济政策不仅在市场层面引发震荡,也在重塑全球政治格局,影响国家间的权力平衡。财政紧缩和贸易战可能进一步加剧社会不满,激化国内政治对立,削弱政府治理能力。而在国际层面,全球供应链重构不仅加剧了经济摩擦,还可能成为各国政策博弈的新战场,推动地缘政治紧张局势升级。

上世纪30年代,贸易保护主义、经济衰退与极端政治交织,最终将世界拖入战争的深渊。今天,类似的信号再次出现:贸易壁垒抬头、国家间经济对抗升级、民粹主义兴起……

历史总是带着相似的韵脚,让人不禁回望过去,试图从中寻找对未来的启示。但尽管全球局势充满不确定性,历史并不会简单重复。

今天的世界拥有比上世纪30年代更多的制衡机制,全球经济联系依然紧密,核武器的威慑力使得大规模战争的成本远高于过去。尽管局部冲突可能加剧,但直接爆发世界大战的可能性很低。

全球经济的割裂正从短期冲突演变为长期趋势。近年来,美中科技脱钩、供应链重构、去美元化加速演进,全球经济正在被重新定义。特朗普政府的经济政策正推动这一进程加速,而其他主要经济体也在寻求应对之策。这种经济割裂不会像战争一样在一夜之间改变世界,但它可能带来更加深远的影响:全球经济合作减少,市场的不确定性上升,资源配置效率降低,各国经济增长放缓,甚至可能出现区域性金融体系的分裂。

特朗普政府的政策不会直接引发世界大战,但它将推动世界走向更深层次的对立与割裂,形成"新冷战"式的经济与政治对抗。

Ready to Start Your Financial Journey? 准备开始您的财务之旅?

Schedule a consultation with our financial planning experts and take the first step toward achieving your financial goals. 与我们的财务规划专家安排咨询,迈出实现财务目标的第一步。

Schedule Your Consultation 安排您的咨询